February 2018 DC Housing Market Update

Posted by Marjorie Dick Stuart on Monday, March 12th, 2018 at 11:18pm.

Still a Seller's Market: DC's housing numbers are in for February 2018

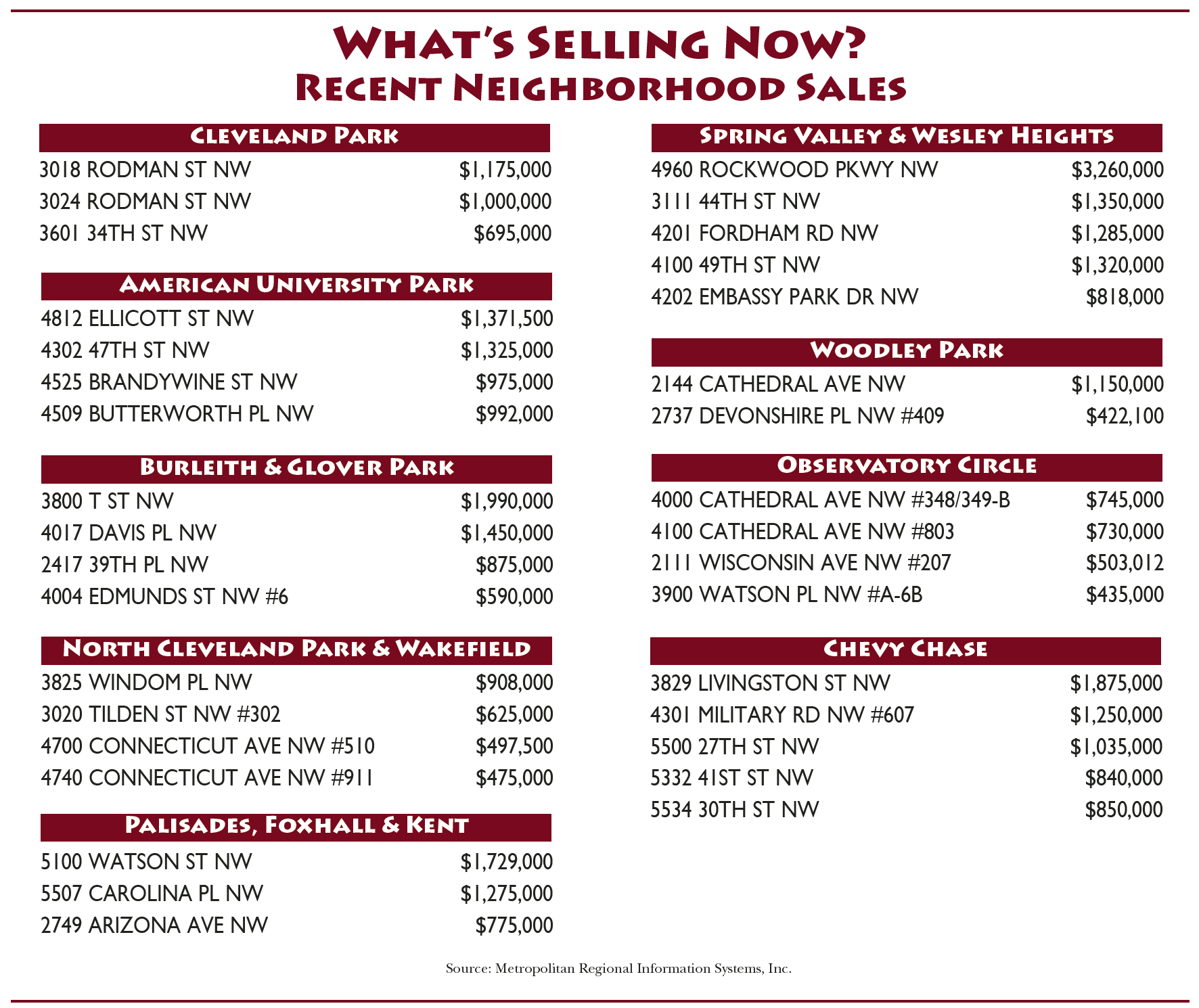

Every month, I review DC's home sale prices, how long it's taking to sell a home, what percentage of list price sellers are getting, and how those indicators seem to be trending. The numbers for February are in (thanks to our friends at the Bright MLS), and I'd like to share them with you here - along with my insights.

Perhaps the most important indicator in the housing market's direction is the change in home prices compared to the same month last year. The chart below (from MarketStats by ShowingTime) shows that home prices are still trending up. In fact, February's median home sale price hit a record high of $410,000; that's the highest we've seen in any February since before 2009.

Many buyers and sellers I work with are still scarred from the housing bubble burst a decade ago. Watching home prices continuing to climb makes them wonder if we're gearing up for another crash. While I can't predict the future, I do have an enormous amount of experience spanning multiple devastating recessions.

The problems that caused the crash of 2008 simply aren't present in today's sellers' market; prices are rising today because authentic demand is outpacing supply. By authentic demand, I mean "qualified buyers." From 2004-2008, millions of completely unqualified buyers were getting financing, which basically meant the demand was artificial. Today, we don't have that problem; but that's not to say that inflation, rising interest rates, and other forces will eventually level out (or lower) home prices.

If you take another look at February's sales data above, you'll notice that the hikes in home prices have become less drastic in the last two years. Also, you'll notice the volume of homes sold has actually backed down a few percentage points from last year. This is a sign that the market is already starting to "level out." That's good news for buyers struggling to find an affordable home, but what does that mean for sellers? It means don't wait to list - the longer sellers wait, the more they risk missing out on peak sale prices.

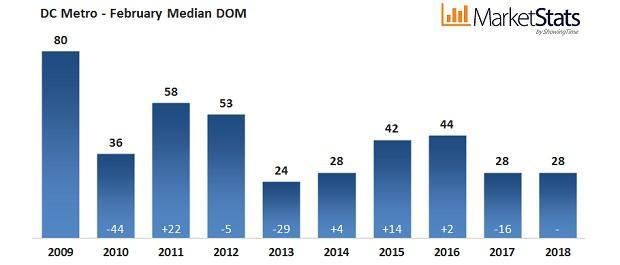

Let's take a quick look at Days on the Market (DOM). In Real-Estate-Agent-Speak, this just means how long it takes a home to enter into a contract from the time it is officially listed on the MLS.

As you can see from the chart, in February of this year we maintained the same 28 days as February 2017. 28 days might seem like a long enough time, but in the home selling business it's a blink of an eye. Over the last four or five decades it's averaged about 90 days. These are fast-moving times, and buyer's who "sleep on it" are simply missing out.

Like home prices, the trend with Days on Market is leveling off. It's not rising - yet - but it's not falling either; which means that supply and demand are getting closer to finding their happy place. Of course, I doubt high prices and fast sales are the new "normal" - in fact, I doubt there will ever be a "normal" in the housing market, especially here in DC. In thirty years, I haven't seen "normal" yet!

While no one would argue that we are still in a seller's market, the tide may be soon turning toward buyers. It doesn't look like prices will be spiking up much higher, so as inventory catches up and Days on Market starts to slow down, buyers will have less competition. And with the Fed talking about a few interest rate hikes later this year, right now buyers are able to compensate for higher home prices by locking in mortgage rates at historically low levels.

The bottom line: it's a great time to sell, and a great time to buy. If you or anyone you know has questions about their DC home (or is planning to move to the area), I'm a phone call away. I'm never too busy to leverage my many years of experience as Cleveland Park's Favorite Agent to help you save as much time and money as possible on your next sale or purchase.